cheapest transfer credit card balance|martin lewis money transfer cards : 2024-09-22 Recommended credit score: 670 - 850. Balance transfer intro APR. 0% Intro APR for 18 billing cycles for any BTs made in the first 60 days. A fee of 3% for 60 days . Voor heren en dames. Kleur: wit. Beschikbaar in maat 46, 43 ⅓, 46 ⅔, 42, 41 ⅔, 45 ⅓, 42 ⅔, 44, 44 ⅓, 48, 37 ⅓, 38 ⅔, 36, 36 ⅔, 38 en 39 ⅓. Materiaal: leer en textiel. Met vetersluiting. Let .

0 · zero percent balance transfer credit cards uk

1 · uswitch 0% balance transfer fee

2 · martin lewis money transfer cards

3 · martin lewis credit cards 0%

4 · martin lewis balance transfer credit card

5 · lowest credit card balance transfer

6 · low interest balance transfer credit cards for life

7 · More

8 · 0% balance transfer credit cards uk

Achtergronden bij de gestegen winstgevendheid van de groothandel. 4. Conclusies. De operationele winsten van de groothandel zijn tussen 1995 en 2023 fors .

cheapest transfer credit card balance*******The Citi® Diamond Preferred® Card offers a super-lengthy 0% intro APR period on balance transfers, and there's also a decent offer on purchases. But the .NerdWallet's . Best Rewards Credit Cards of July 2024. Wells Fargo Active Cash® .The Discover it® Cash Back has a 0% intro APR for 15 months on purchases and .

Recommended credit score: 670 - 850. Balance transfer intro APR. 0% Intro APR for 18 billing cycles for any BTs made in the first 60 days. A fee of 3% for 60 days .

Here are some of the best balance transfer credit cards on the market, based on their Finder Score: The St.George Vertigo Card has a Finder Score of 10. It has a 0% balance transfer offer for 28 .

martin lewis money transfer cards Annual fee: $0. Other benefits and drawbacks: The card offers a 0% intro APR for 18 billing cycles for purchases and for any balance transfers made in the first 60 days from account opening, 16.24 .Note: Membership with the Financial Fitness Association (for a minimal $8/year) may fulfill a requirement for obtaining this card. (2) Edward Jones World Mastercard. (3) M&T Visa Credit Card. (4) The Union Bank® Platinum™ Visa® Credit Card. Note: the introductory period is 15 months, rather than 12.

Top long-0% purchase cards for new cardholders. Barclaycard. Longest 0% spending card on the market of 'up to' 21mths, though some could get fewer interest free months. If you're pre-approved in our eligibility calculator you'll definitely get 21 months at 0%, otherwise you could be accepted and get just 10 months. - Up to 21mths 0%.

You move the balance to a card with a 0% promotional offer for 24 months, with a 2% balance transfer fee. You now owe a total of £3,060, including the one-off fee. By paying £128 on time each month for 24 months, with no other spending, you can clear your balance without paying any interest. [2]Compiled using MoneyHelper’s credit card .

The best credit card rates are 0% APRs that last for 15 months or longer. Credit cards offering 0% rates on new purchases can be interest-free for about 11 months on average, and balance transfer cards average around 13 months with 0% rates. The best regular interest rates on credit cards are below 14%. 3% intro balance transfer fee ($5 minimum) for the first four months after account opening, then 5% ($5 minimum) U.S. Bank Visa® Platinum Card. $0. 0% introductory APR on purchases and balance . The Citi Custom Cash® Card offers a lot of value for a $0 annual fee: 5% back automatically in your eligible top spending category on up to $500 spent per billing cycle (1% back on other spending .

The best balance transfer credit card for fair credit is the Citi Double Cash® Card because it offers an introductory APR of 0% for 18 months on balance transfers made within 4 months of opening an account. This card also has a $0 annual fee. The Citi Double Cash Card 's regular APR is 19.24% - 29.24% (V). It offers a 0% intro APR on balance transfers for 18 months. After that, the standard variable APR will be 19.24% to 29.24%. An intro balance transfer fee of either $5 or 3%, whichever is greater .

The interest rate charges for any outstanding balance on your credit card are compounded daily according to a tiered interest rate system. Most credit cards charge interest using this tier: 15% p.a. – if you pay your credit card bills on time for 12 consecutive months; 17% p.a. – if you pay your credit card bills on time for 10 out of 12 months Rewards Rate. The Citi Double Cash offers one of the longest balance transfer periods on a rewards card. It also is one of the most rewarding cash-back credit cards without an annual fee. It . With most cards, a fee of 3% to 5% of the amount transferred is added to your balance on the new card when the debt moves over. For example, if you transfer a $5,000 balance to a card with a 3% . 0% p.a. interest rate on balance transfers for 9 mths. Rate reverts to 22.74% p.a. Balance transfer fee of 1% applies. 0% p.a. interest rate on purchases for 9 mths. Rate reverts to 21.99%. Canstar Exclusive Offer: Free FIRST membership. 0.00% p.a. interest rate on balance transfers for 28 mths.

The interest rate charges for any outstanding balance on your credit card are compounded daily according to a tiered interest rate system. Most credit cards charge interest using this tier: 15% p.a. – if you pay . Rewards Rate. The Citi Double Cash offers one of the longest balance transfer periods on a rewards card. It also is one of the most rewarding cash-back credit cards without an annual fee. It . With most cards, a fee of 3% to 5% of the amount transferred is added to your balance on the new card when the debt moves over. For example, if you transfer a $5,000 balance to a card with a 3% .

0% p.a. interest rate on balance transfers for 9 mths. Rate reverts to 22.74% p.a. Balance transfer fee of 1% applies. 0% p.a. interest rate on purchases for 9 mths. Rate reverts to 21.99%. Canstar Exclusive Offer: Free FIRST membership. 0.00% p.a. interest rate on balance transfers for 28 mths.cheapest transfer credit card balance 0% p.a. interest rate on balance transfers for 9 mths. Rate reverts to 22.74% p.a. Balance transfer fee of 1% applies. 0% p.a. interest rate on purchases for 9 mths. Rate reverts to 21.99%. Canstar Exclusive Offer: Free FIRST membership. 0.00% p.a. interest rate on balance transfers for 28 mths.0% balance transfer offer for 28 months with 2% BT fee (reverts to cash advance rate). $59 annual fee, or free the first year if you're an existing Westpac customer. Free additional cardholder. 13.74% p.a. 0% 28 months reverts to 21.99% p.a. 2% fee applies.cheapest transfer credit card balance martin lewis money transfer cards Some offers might be for 6 months; others for 18. Whatever the number of months, divide your balance by it, and see if you could reasonably swing that monthly payment. Don’t forget to tack on the balance transfer fee, which is usually about 2% to 3% of the total balance. 2. Consider your current situation more closely.Tesco Bank. Longest 0% period, which all accepted will get. You'll get the full 29 months at 0% if you're accepted for this card, and if you're pre-approved in our eligibility calculator you can be certain you'll be accepted (provided you pass Tesco Bank's ID & fraud checks). - 29 months 0%. - 3.49% fee. 1. Review Your Existing Debt. Take time to review your credit cards that have a balance. Take note of how much you owe and the interest rate for each card. Your interest rate and your APR are the .

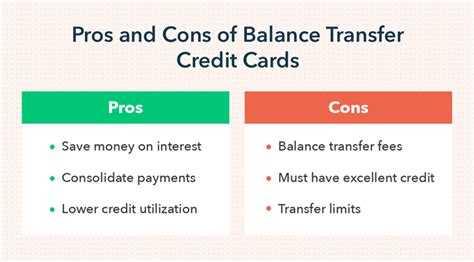

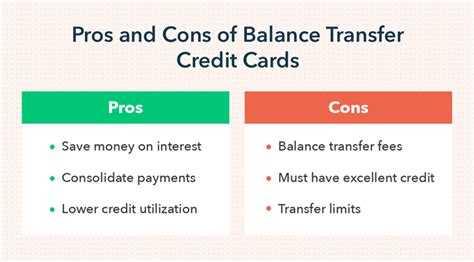

Most balance transfer cards charge balance transfer fees of 3 percent to 5 percent of your balance. So, if you transfer $5,000 to a balance transfer card, you could pay an extra $150 to $250 in fees. 1. Request a balance transfer. Typically, the first step of doing a balance transfer is getting in touch with the issuer of the card to which you're moving debt and providing some information . Balance transfer offer: Chase Freedom Flex card holders can transfer balances and take advantage of an intro 0% APR for 15 months, then a variable 20.49% to 29.24% APR applies. This card’s intro .

A 0% APR balance transfer is a great way to pay down the principal on your credit card debt, saving you hundreds of dollars in interest. We found that the longest 0% APR balance transfer offer is 21 months, so you won’t pay interest until 2026. The best cards for balance transfer offer an average savings of more than $1,000 over the intro period.

De schoen heeft een normale pasvorm en is voorzien van een vetersluiting. Op verschillende plaatsen op de Coast Star prijken de ‘three stripes’ en het bekende .

cheapest transfer credit card balance|martin lewis money transfer cards